What is a Medicare Supplement?

Supplemental health insurance plans or Medicare Supplements, also known as Medigap policies, serve as a crucial component in ensuring comprehensive healthcare coverage for seniors. Sold by private insurance companies, these plans act as a safeguard against the out-of-pocket costs left behind by Medicare, offering financial security and peace of mind.

When you possess a Medigap policy, it collaborates with Medicare to cover medical expenses up to Medicare's limit. Subsequently, your Medicare Supplement plan steps in to cover costs up to its limit. The extent of coverage beyond Medicare's limit depends on the specific policy chosen, emphasizing the importance of selecting a plan that aligns with individual healthcare needs.

What do Medicare Supplements cover?

Original Medicare only covers 80% of your Part B expenses. The other 20% comes out of your pocket if you do not have a Medicare Supplement policy also referred to as Medigap. If you were to have a lengthy stay in a hospital or expensive treatments at outpatient facilities, you can see how that could add up. Medicare Supplements pay that 20% for you.

Is there anything not covered by Medicare Supplement Plans?

Things that are not covered by Original Medicare on your Medicare Supplement:

Routine dental, vision, and hearing exams

Hearing aids

Eyeglasses or contacts

Long-term care or custodial care

Retail prescription drugs

Seniors can customize their supplemental insurance for seniors by exploring various options, ensuring alignment with their unique healthcare needs.

Which Medigap Plans Can I Choose From?

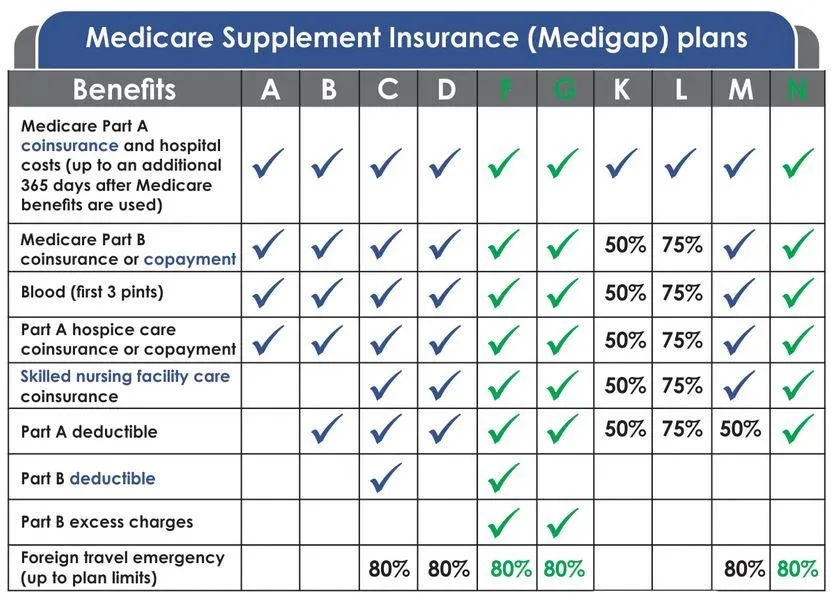

Choosing the right Medigap plan involves careful consideration, empowering seniors to customize coverage for individual healthcare needs. The flexibility offered ensures a personalized approach, addressing unique preferences and requirements.

Particularly, when it comes to oral health, seniors may find value in exploring Medigap plans that include Medicare supplemental dental insurance. This additional coverage can be a crucial component of a comprehensive healthcare strategy, addressing dental needs that may not be fully covered by standard Medicare plans. By incorporating supplement insurance for seniors that includes dental coverage, individuals can enhance their overall well-being, ensuring that oral health is an integral part of their personalized healthcare approach.

The plans that are highlighted in green above are the 3 most popular and cheapest medicare supplement plans that clients choose when selecting a Medigap/Medicare Supplement plan.

Get a Consultation

& Quote at No Cost

Copyright © 2020 -2026 All Rights Reserved

Phone: 833-373-4357 Email: theinsguy77@gmail.com